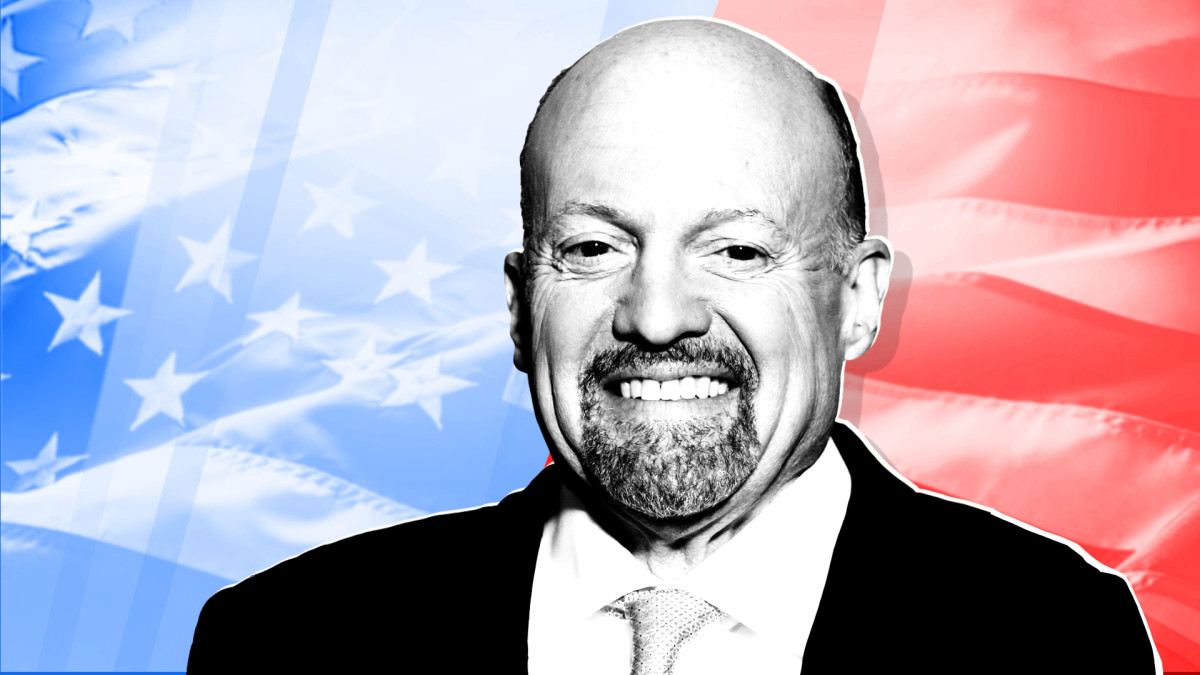

Next week is jam-packed with more earnings reports, Jim Cramer told his Mad Money viewers Friday, but that's a good thing, because talking about earnings is way better than talking about Bitcoin. Cramer said the easy money has already been made in cryptocurrencies, but stocks still have a long way to go.

In his Real Money column, Cramer writes: It is imperative that either Treasury Secretary Janet Yellen or SEC Chairman Gary Gensler simply come out and say they are uncomfortable with all of the leverage they are seeing in the crypto markets. Read more from Cramer in Here's How We End the Crypto Madness.

Cramer's game plan for next week starts on Monday with Lordstown Motors (RIDE) - Get Report, the EV maker that's burned investors in the past, which is why Cramer's not recommending it.

On Tuesday we'll hear from AutoZone (AZO) - Get Report, Intuit (INTU) - Get Report and Toll Brothers (TOL) - Get Report. Cramer was bullish on all three, but noted that Toll Brothers needs to be perfect to head higher.

Next, on Wednesday, it's earnings from Dick's Sporting Goods (DKS) - Get Report, Williams-Sonoma (WSM) - Get Report and American Eagle Outfitters (AEO) - Get Report in retail. We'll also hear from Nvidia (NVDA) - Get Report, Snowflake (SNOW) - Get Report, Okta (OKTA) - Get Report and Workday (WDAY) - Get Report in tech, as well as Mondelez (MDLZ) - Get Report in food. Cramer was particularly bullish on Mondelez.

Thursday's standout earnings include Ulta Beauty (ULTA) - Get Report, Costco (COST) - Get Report and Medtronic (MDT) - Get Report, all Cramer favorites.

And finally on Friday, we'll hear from Big Lots (BIG) - Get Report, another favorite in the retail sector which should deliver terrific numbers.

Cramer and the AAP team are looking at everything from earnings and politics to the Federal Reserve. Find out what they're telling their investment club members and get in on the conversation with a free trial subscription to Action Alerts Plus.

Executive Decision: Sysco

In his first "Executive Decision" segment, Cramer spoke with Kevin Hourican, president and CEO of food distributor Sysco (SYY) - Get Report, which just completed an analyst day that included a $5 billion share repurchase authorization and a boost to the company's dividend.

Hourican said it's clear that the recovery is finally here and restaurants are getting back into full swing. He only saw more upside and success to come.

When asked about the number of restaurants that closed during the pandemic, Hourican said they estimate less than 10% of locations have been permanently closed, but Sysco is now serving 10% more customers now that the industry has consolidated.

Hourican continued that Sysco's recipe for growth includes new digital tools, better marketing, supply chain improvements and a focus on cuisines. Even their order delivery has increased in frequency, so restaurants will have what they need.

Executive Decision: SailPoint Technologies

For his second "Executive Decision" segment, Cramer spoke with Mark McClain, co-founder and CEO of cybersecurity company SailPoint Technologies (SAIL) - Get Report.

McClain said that SailPoint acts as your IT wingman. The digital transformation depends on trust, he said, and identity is at the core of trust. That's why SailPoint has become valuable to companies.

Identity services aren't just for humans anymore, either. McClain explained that apps for loan applications are assessing credit risk digitally now, which means programs are accessing the multiple systems, just as a human used to do. All of those interactions must also be secured.

As cybersecurity and ransomware continues to dominate the headlines, SailPoint will continue to be in demand, he said.

On Real Money, Cramer keys in on the companies and CEOs he knows best. Get more of his insights with a free trial subscription to Real Money.

Get Out and Play

The great outdoors is here to stay, and the best way to play the trend is with Yeti Holdings (YETI) - Get Report, makers of high-performance outdoor gear.

Cramer said it's been a mistake to bet against Yeti ever since it came public in 2018, and when the company reported last week, the earnings were again spectacular. Yeti delivered both a top and bottom line beat with 42% revenue growth. That's tech company growth, Cramer quipped.

Additionally, Yeti's direct-to-consumer business, which has far better margins, grew by a stunning 59%. With shares up 25% for the year, Cramer said Yeti is still a buy giving all of this growth.

As for some other outdoor names, big ticket items like Brunswick (BC) - Get Report, Thor Industries (THO) - Get Report and Winnebago (WGO) - Get Report are all down big from their highs, but Cramer said he's not giving up on these outdoor names, either. Stocks get cheaper as they go lower, he reminded viewers.

We Didn't Trust the Science

In his No-Huddle Offense segment, Cramer asked, how did every retailer get caught short of just about everything? His answer: a lack of optimism.

A year ago, no one believed our drugmakers could deliver a vaccine in less than four years. They also continued to rely on just-in-time inventory management that fails when global travel falls apart and shipping ports become overwhelmed.

Indeed, just about every retailer other than Target (TGT) - Get Report seems to have gotten caught off guard. And while it came as a total surprise, Cramer said at least it's a good surprise.

Lightning Round

Here's what Cramer had to say about some of the stocks that callers offered up during the Mad Money Lightning Round Friday evening:

Nokia (NOK ADR) : "They had a good quarter. So did LM Ericsson (ERIC) - Get Report."

Marathon Oil (MRO) - Get Report: "I like Chevron (CVX) - Get Report and Pioneer Natural Resources (PXD) - Get Report."

Opko Health (OPK) - Get Report: "This is problematic. I say pass."

Boston Omaha (BOMN) - Get Report: "This is a conglomerate of a bunch of things. I say hard pass."

WD-40 (WDFC) - Get Report: "That last quarter was horrible. They're in the penalty box."

UP Fintech Holding (TIGR) - Get Report: "That's Chinese fintech. No way."

MP Materials MP: "This is a SPAC and short term it's going to be bad. Longer term, it'll work out."

Search Jim Cramer's "Mad Money" trading recommendations using our exclusive "Mad Money" Stock Screener.

To watch replays of Cramer's video segments, visit the Mad Money page on CNBC.

To sign up for Jim Cramer's free Booyah! newsletter with all of his latest articles and videos please click here.

At the time of publication, Cramer's Action Alerts PLUS had a position in NVDA, COST.

"motors" - Google News

May 22, 2021 at 07:23AM

https://ift.tt/3oG8Off

Cramer's Mad Money Recap: Lordstown Motors, Intuit, Costco - TheStreet

"motors" - Google News

https://ift.tt/2SwmEC9

https://ift.tt/3b0YXrX

Bagikan Berita Ini

0 Response to "Cramer's Mad Money Recap: Lordstown Motors, Intuit, Costco - TheStreet"

Post a Comment