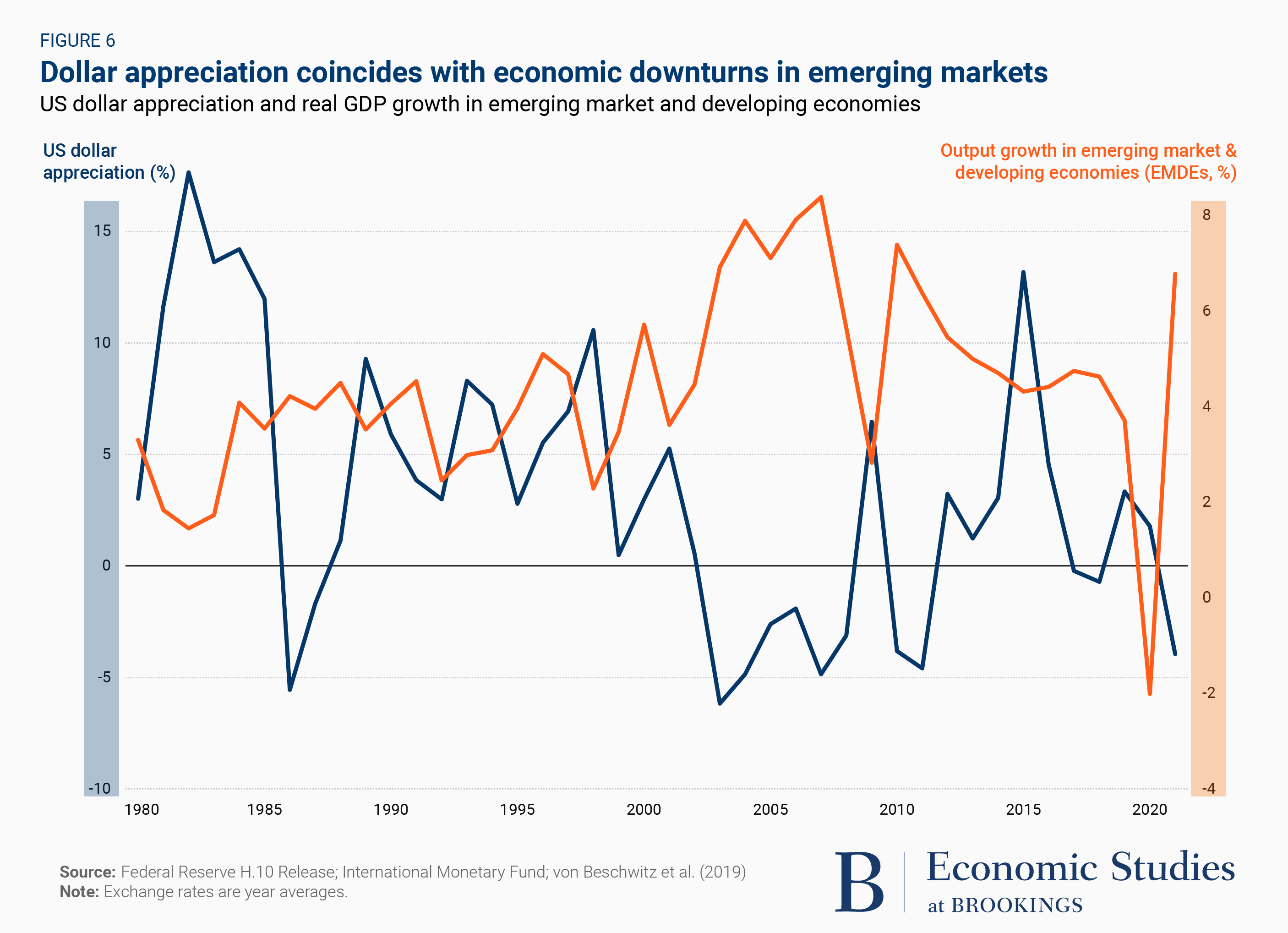

A rising dollar—driven by the Federal Reserve’s inflation-quelling interest rate increases and investors’ diminished risk appetite—could cause downturns in many emerging market and developing economies (EMDEs), suggests a paper to be discussed at the Brookings Papers on Economic Activity (BPEA) conference on September 9.

“The dollar has strengthened considerably since mid-2021 and a contractionary phase of the global financial cycle is now under way,” write the authors, Maurice Obstfeld of the University of California-Berkeley and Haonan Zhou of Princeton University.

The paper—The Global Dollar Cycle—uses a statistical model tracking variables across 26 EMDEs to document how dollar-appreciation shocks lead to economic downturns, a feature of the world economy since the early 1970s when the Bretton Woods system of fixed exchange rates fell apart. And their findings point to policies that countries can put in place to mitigate the adverse effects of a stronger dollar.

“The dollar has strengthened considerably since mid-2021 and a contractionary phase of the global financial cycle is now under way.”

Increases in public- and business-sector debts during the COVID-19 pandemic have left EMDEs particularly vulnerable to dollar appreciation now, the authors write. Most borrow substantially in dollars; thus, a stronger dollar increases the burden of their debts in terms of the output of their domestic economies. That, in combination with higher interest rates and slower economic growth (which erodes government tax receipts and business profits), makes it more difficult for EMDEs pay their debts.

Obstfeld, in an interview with The Brookings Institution, said that although the latest run-up in the dollar is not yet exceptionally big, it comes at a time when the world economy faces persistent pandemic-related supply-chain disruptions, the war in Ukraine, and high energy and food prices.

“It could make the denouement of this dollar-appreciation episode particularly grim,” he said.

The paper notes that EMDEs can strengthen their defenses against a rising dollar by minimizing their dollar-denominated debt in the first place, by allowing flexibility in their exchange rates, and by establishing central banks with strong anti-inflation credibility. Indeed, many EMDE central banks began raising their policy rates last year, ahead of the Federal Reserve and other advanced-economy central banks. That should, Obstfeld said, provide those EMDEs with some protection against a financial crisis but at the expense of slower domestic growth.

The paper says the Federal Reserve’s actions early in the pandemic, including swap (lending) lines to other central banks and a facility that allowed foreign central banks to sell their U.S. Treasury securities, were “especially important in stabilizing world financial markets.” But, it observes, “the Fed has been rather late to the game” in raising its short-term policy interest rate to counter inflation. The first increase came in March 2022.

The paper predicts that the Fed and other advanced-economy central banks likely will succeed in taming inflation but warns, “there is a danger that central banks jointly create an unnecessarily sharp global recession.”

Obstfeld’s and Zhou’s paper is being presented as the March 2023 50th anniversary of the demise of the Bretton Woods system draws near. At the time, many countries adopted floating exchange rates to decouple their currencies, and thus their economies, from the dollar. But the dollar and U.S. monetary remain prime driving forces of international financial conditions and economic outcomes.

“At some level, it is ironic,” Obstfeld said.

Citation

Obstfeld, Maurice and Haonan Zhou. 2022. “The Global Dollar Cycle.” BPEA Conference Draft, Fall.

"cycle" - Google News

September 08, 2022 at 08:39AM

https://ift.tt/O3Lgbil

The global dollar cycle - Brookings Institution

"cycle" - Google News

https://ift.tt/mHdZR6q

https://ift.tt/OBFYdo8

Bagikan Berita Ini

0 Response to "The global dollar cycle - Brookings Institution"

Post a Comment