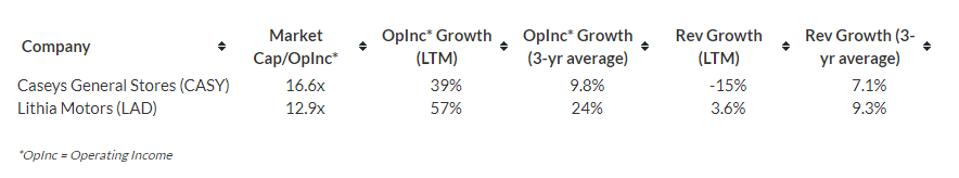

We believe that Lithia Motors (NYSE: LAD) is currently better valued than Casey’s General Stores. CASY’s current market cap-to-operating income ratio of 17x is higher than levels of 13x for Lithia Motors. But does this gap in valuation make sense? We don’t think so, especially if we look at the fundamentals of these companies. More specifically, we arrive at our conclusion by looking at historical trends in revenues, operating income, and the market cap-to-operating income ratio for these companies. Our dashboard Better Bet Than Casey’s General Stores: Pay Less To Get More From LAD has more details – parts of which are summarized below.

1. Revenue Growth

Casey’s General Store revenue grew at an average rate of 7% over the last three years, as compared to revenue growth of 9% for LAD. Even if we look at the revenue growth over the last twelve-month period - CASY’s revenue growth of -15% is worse as compared to a 3.6% growth for LAD.

- Casey’s General stores is a gas station and convenience store chain. These stores carry a selection of food, beverages, tobacco products, health and beauty aids, automotive products, and other non-food items, and unlike many other chains, primarily function in exurban and rural areas. While sales of gasoline accounts for more than 60% of the company sales, it is still a high-volume and low-margin product. So it generates much of the actual earnings from sales made inside the convenience store attached to the filling station. In the first nine months of fiscal 2021 (year ended April 2021), Casey’s succeeded in making more from less, seeing earnings per share rose a strong 34% year-over-year (y-o-y) to $7.33 per share, even though total revenue was down 14% y-o-y to $6.3 Bil. A higher grocery volume and increased fuel margins drove the earnings.

- Lithia Motors is a major player in the car dealership space - selling new, used, imported, and luxury vehicles. The company’s revenues grew 4% y-o-y in 2020, due to increased sales of used cars offset by a decline in demand for new vehicles. The company’s results mirrored outperformance largely across the board in Q1 as well. It saw the highest adjusted first-quarter earnings in company history at $5.89 per share, a 193% increase over last year, and record revenue growth of 55% y-o-y.

2. Operating Income Growth

The three-year average operating income growth for Casey’s stands at 10%, much lower than 24% for Lithia Motors. Better revenue growth for the latter led to higher operating income. Looking at the last twelve-month period, CASY’s 39% rise in operating income compares with 57% gains for LAD.

The Net of It All

Lithia Motors has seen higher growth in revenues and operating income than Casey’s General Stores in the last twelve months, as well as the last three years. Yet, it appears to be cheaper than CASY. Despite better profit and revenue growth, Lithia Motors has a comparatively lower market cap-to-operating income ratio.

CASY’s underperformance in revenue and operating income growth compared to LAD reinforces our conclusion that the stock is expensive compared to its peer, and we think this gap in valuation will eventually narrow over time to favor the less expensive name, Lithia Motors.

While Lithia Motors appears to currently be a better investment than Casey’s General Stores, it is helpful to see how its peers stack up. Lithia Motors Stock Comparison With Peers shows how LAD compares against peers on metrics that matter.

See all Trefis Featured Analyses and Download Trefis Data here

"motors" - Google News

June 09, 2021 at 05:00PM

https://ift.tt/3w9W4k5

Here’s Why Lithia Motors Stock Is A Better Bet than Casey’s General Stores - Forbes

"motors" - Google News

https://ift.tt/2SwmEC9

https://ift.tt/3b0YXrX

Bagikan Berita Ini

0 Response to "Here’s Why Lithia Motors Stock Is A Better Bet than Casey’s General Stores - Forbes"

Post a Comment